The Employee Provident Fund (EPF) is a significant financial benefit for employees in India, offering a reliable savings avenue for retirement. However, did you know that you can also avail of an EPF loan in times of need? With the digitization of services, applying for an EPF loan online has become more accessible and convenient. In this blog, we’ll provide you with a comprehensive step-by-step guide on how to apply for an EPF loan online.

Before applying for an EPF loan, it’s crucial to be aware of the eligibility criteria. Generally, you should have a minimum EPF balance (more than Rs. 20,000) and an active EPF account.

You should also have a valid reason for availing the EPF Loan or Advance. You can request for an EPF loan for any of the following reasons:

Visit the official EPFO (Employee Provident Fund Organization) website.

Log in to your UAN (Universal Account Number) portal using your UAN and password. If you haven’t registered, follow the registration process provided on the website.

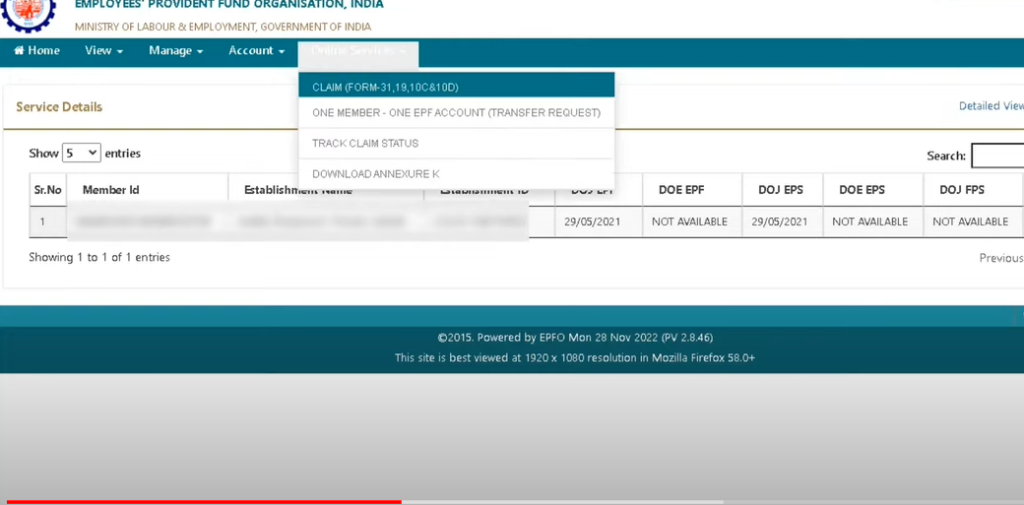

Once logged in, navigate to the ‘Online Services’ section on the portal’s main menu. Under the ‘Online Services’ section, select the ‘Claim (Form-31, 19 & 10C)’ option to initiate the EPF loan application.

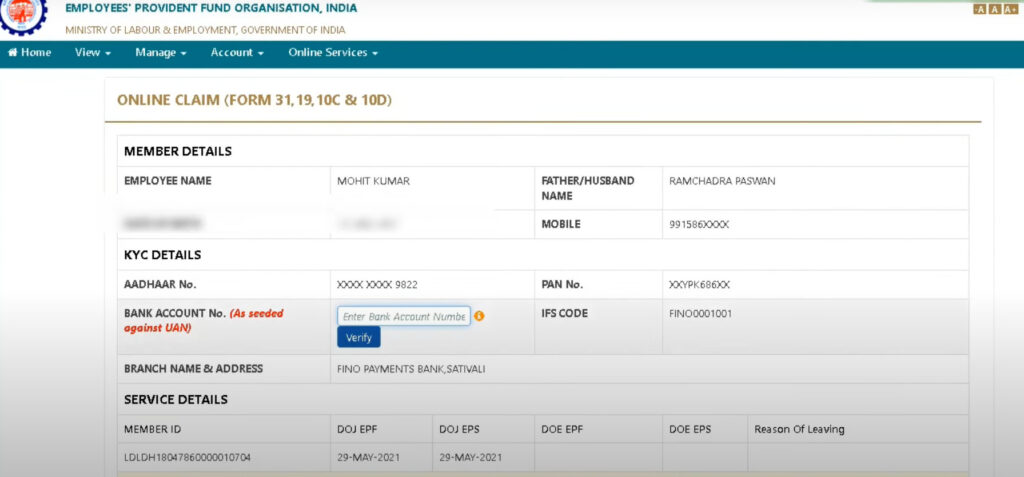

Your personal details such as name, date of birth, and Aadhaar number will be pre-filled based on your UAN information. Verify and provide your bank account details where you want the loan amount to be credited.

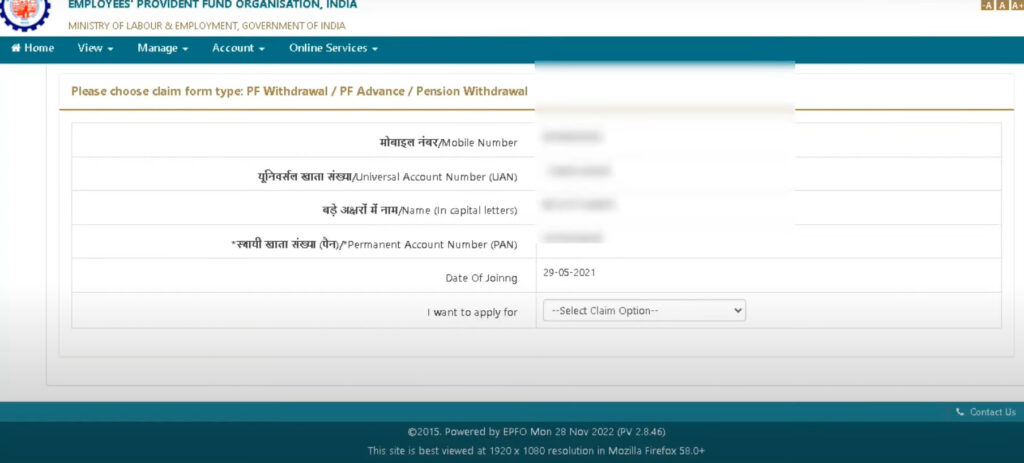

Choose the type of claim you wish to make – for an EPF advance (loan) or for partial withdrawal. Select the ‘PF Advance (Form-31)’ option for applying for an EPF loan.

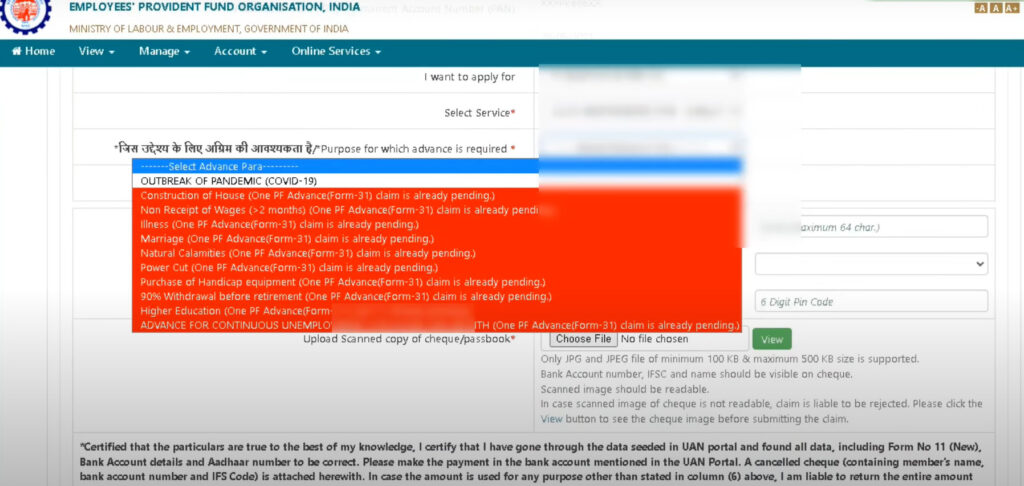

Indicate the purpose for which you require the loan. Options include medical expenses, marriage, education, housing, etc. Provide additional information related to the purpose selected.

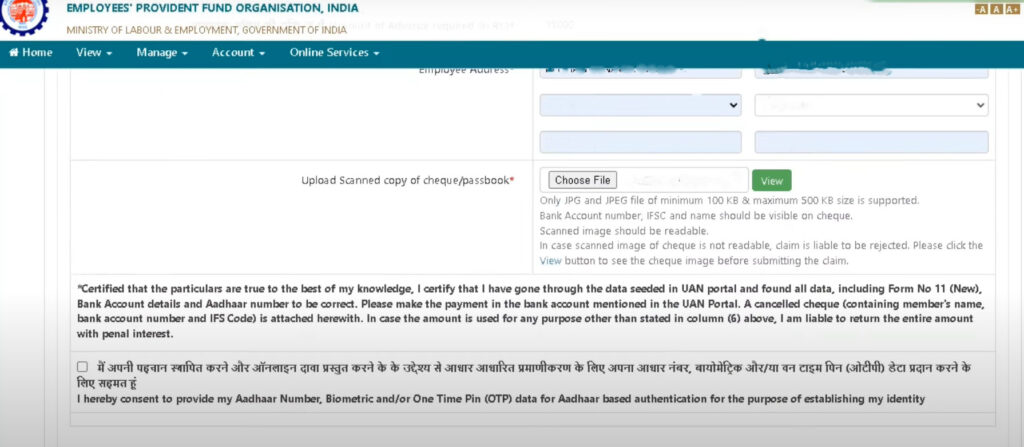

After you mention the amount of loan you want to apply for, upload any required supporting documents based on the purpose of the loan. This usually includes a scanned copy of your cheque or passbook.

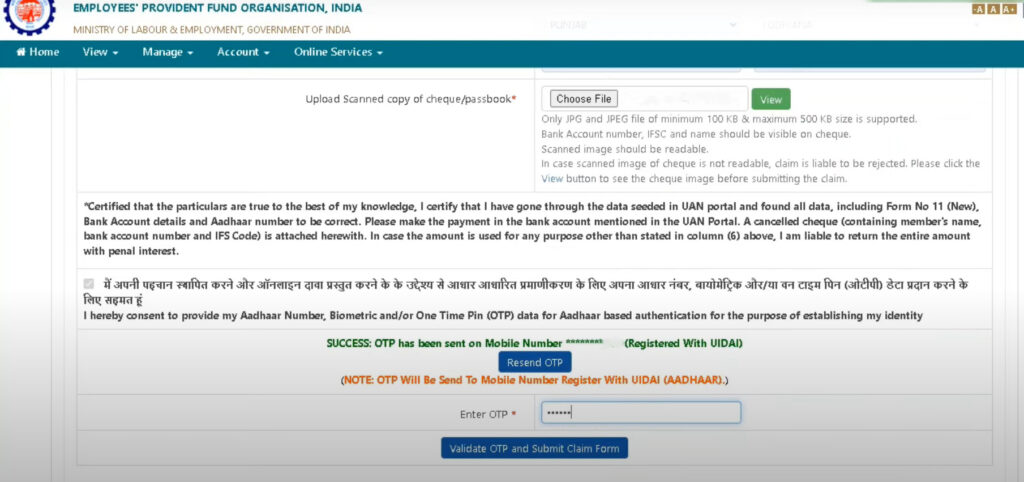

Verify the details you’ve provided and authenticate your application using your Aadhaar-based e-KYC.

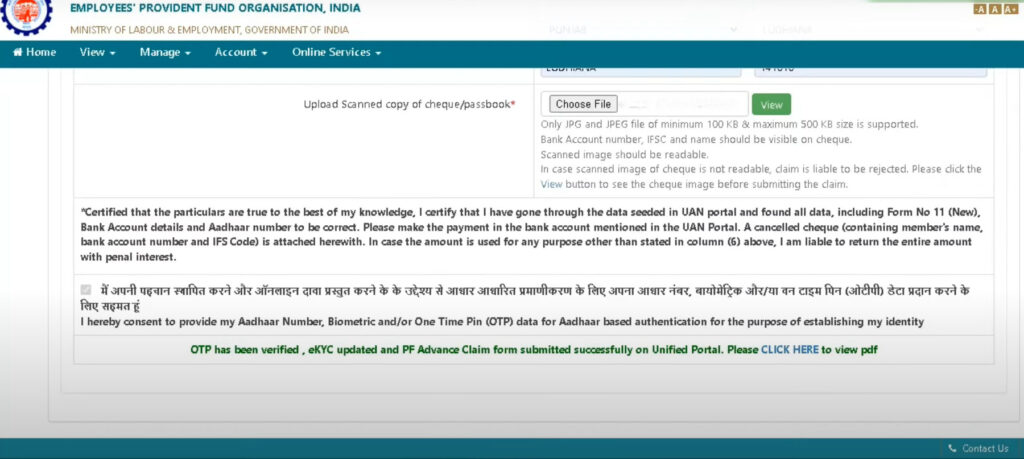

Once you’ve reviewed and verified your application, submit it electronically.

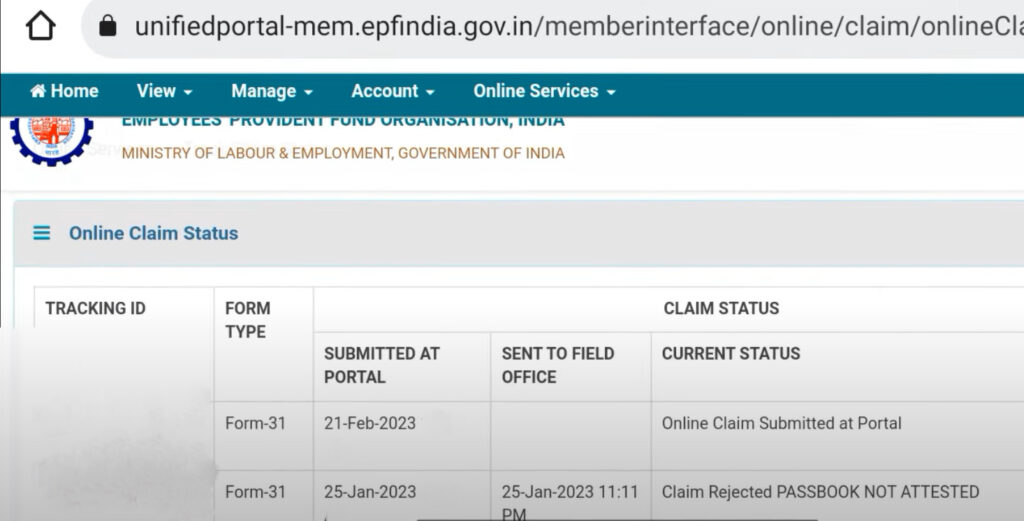

After submitting the application, you can track its status on the EPF UAN portal. The portal will provide updates on the progress of your application, including approval and disbursal.

Here are some things you should keep in mind before applying for an EPF loan:

The ability to apply for an EPF loan online has simplified and expedited the process for employees in need of financial assistance. By following this step-by-step guide, you can navigate the EPF UAN portal with ease and apply for an EPF loan tailored to your specific requirements. As with any financial decision, it’s essential to understand the terms and conditions associated with EPF loans and ensure you are well-informed before proceeding.

Finnable has set a required minimum age for personal loan of 21 years for individuals to be eligible for a personal loan. This ensures that applicants have reached legal adulthood and are capable of entering into a financial agreement.

Yes, Finnable understands the financial needs of young borrowers and offers personalised loan options tailored to their specific requirements. Whether it's financing higher education, purchasing essential items, or starting a business venture, Finnable provides support to young individuals seeking financial assistance.

Borrowers nearing retirement may have unique financial needs, such as retirement planning, medical expenses, or supporting their children's education. Finnable offers personalised loan solutions that consider the specific circumstances of pre-retirement individuals, helping them meet their financial goals.

Unfortunately, no. Finnable does not, at the moment, offer any loans to senior citizens. Currently, 60 is the maximum age for personal loans set by Finnable

Other than personal loan age limits , Finnable considers various other factors for determining loan eligibility. These factors may include the applicant's income, credit score, repayment capacity, and employment stability. By assessing these aspects comprehensively, Finnable ensures that borrowers across different age groups can access the loan products that best suit their financial needs.

I am a seasoned retail banker with over 21 years of global experience across business, risk and digital. In my last assignment as Global Head Digital Capabilities, I drove the largest change initiative in the bank to deliver the end-to-end digital program with over US$1 billion in planned investment. Prior to that, as COO for Group Retail Products & Digital, I implemented a risk management framework for retail banking across the group.

Terms and condition and legal disclaimer

Finnable is a personal loan app developed by Finnable Technologies Private Limited, which is a subsidiary of Finnable Credit Private Limited, a RBI licensed NBFC.

Example of Personal Loan for Salaried Professionals

✓ Loan Amount from ₹50,000 to ₹10,00,000

✓ Repayment period (loan tenor) options vary from 6 to 60 months

✓ Annual Interest Rate (APR) is 16% to 26% (on a reducing balance basis) + processing fees of 3 to 4% on the principal loan amount

✓ For Example – a loan of ₹1,00,000 with an APR of 16% (on a reducing balance basis), repayment tenure of 12 months, processing fee of 3%. The processing fee will be ₹3,000 + ₹540 GST with monthly EMI will be ₹9,394. The total loan amount will be ₹1,03,540. Total interest payable over 12 months will be ₹9,191. Total loan repayment amount is ₹103540 + ₹9191 = ₹1,12,731 *These numbers are for representation only and the final interest rate or processing fee may vary from one borrower to another depending on his/her credit assessment.

✓ Loan Prepayment Charges: 3 to 6% charge + 18% GST on the remaining principal amount (allowed after 6 EMI payments)

Why is Finnable the best personal loan app?

Instant Loans within 48 hours: Gone are the days when you had to wait weeks & months to get a loan approved.

Completely Digital/Paperless: Finnable instant loan app offers a complete digital service to help save time as well as paper!

Security & Privacy Policy

Finnable instant loan app ensures the safety of its customers via standard security. In simple terms, we do not share personal information

with third-party apps.

Contact Us: Drop us an email: makeiteasy@finnable.com

Address: IndiQube Lakeside, 4th Floor Municipal No. 80/2 Wing A, Bellandur Village Varthur, Hobli, Bengaluru, Karnataka 560103

Responsible Lending

Finnable has partnered with RBI authorised & regulated NBFCs/Financial Institutions.

Our policies and services are fully regulated and legally compliant.

Finnable is one of the fastest growing financial technology (Fintech) start-up with an NBFC license from RBI providing hassle free loans. Our mission is to make Personal loans available in less than 24 hours

Example of Personal Loan for Salaried Professionals

✓ Loan Amount from ₹50,000 to ₹10,00,000

✓ Repayment period (loan tenor) options vary from 6 to 60 months

✓ Annual Interest Rate (APR) is 16% to 26% (on a reducing balance basis) + processing fees of 3 to 4% on the principal loan amount

✓ For Example – a loan of ₹1,00,000 with an APR of 16% (on a reducing balance basis), repayment tenure of 12 months, processing fee of 3%. The processing fee will be ₹3,000 + ₹540 GST with monthly EMI will be ₹9,394. The total loan amount will be ₹1,03,540. Total interest payable over 12 months will be ₹9,191. Total loan repayment amount is ₹103540 + ₹9191 = ₹1,12,731 *These numbers are for representation only and the final interest rate or processing fee may vary from one borrower to another depending on his/her credit assessment.

✓ Loan Prepayment Charges: 3 to 6% charge + 18% GST on the remaining principal amount (allowed after 6 EMI payments)

Why is Finnable the best personal loan app?

Instant Loans within 48 hours: Gone are the days when you had to wait weeks & months to get a loan approved.

Completely Digital/Paperless: Finnable instant loan app offers a complete digital service to help save time as well as paper!

Why is Finnable the best personal loan app?

Instant Loans within 48 hours: Gone are the days when you had to wait weeks & months to get a loan approved.

Completely Digital/Paperless: Finnable instant loan app offers a complete digital service to help save time as well as paper!

CIBIL Score Not Required for Taking a Loan: Unlike other personal loan apps online, you can take a loan even without an existing CIBIL Score

No Hidden Charges: A key feature that makes Finnable one of the best loan apps available is transparency. There are no hidden charges whatsoever, making the entire process a smooth one.

Finnable instant loan app offers a wide range of EMI plans. You can also use our personal loan EMI calculator to help you choose the perfect plan.

Loan Eligibility Criteria for Salaried Individuals (No Blue-Collar Employees)

•The net in-hand salary of the individual has to be ₹25k and above in metros or ₹15k and above in tier 2 & other cities

•He/she should have worked for more than six months

•First-time borrowers need to have a Finnable score of 650

•The individual should have valid Aadhaar, Pan & Address proof

•Finnable Loan is currently available in 23 cities

How to Apply for Instant Personal Loans Online?

• Register with OTP

• Ensure that you have the documents listed on the Web/App

• Provide details of amount required, net monthly salary & any other EMIs

• Do KYC & profile setup

• Validate address with pin code verification

• Select amount & tenure

• Provide bank details

APR Charges

The APR (Annual Percentage Rate) charges differ from person to person as it considers the different products availed and the risk profile of the customer. However, it generally ranges between 16%-26%.

Security & Privacy Policy

Finnable instant loan app ensures the safety of its customers via standard security. In simple terms, we do not share personal information

with third-party apps.

Contact Us: Drop us an email: makeiteasy@finnable.com

Address: IndiQube Lakeside, 4th Floor Municipal No. 80/2 Wing A, Bellandur Village Varthur, Hobli, Bengaluru, Karnataka 560103

Responsible Lending

Finnable has partnered with RBI authorised & regulated NBFCs/Financial Institutions.

Our policies and services are fully regulated and legally compliant.